Underlying $79 million profit before significant impairment writedowns.

SCA today announced its financial results for the full year to 30 June 2014.

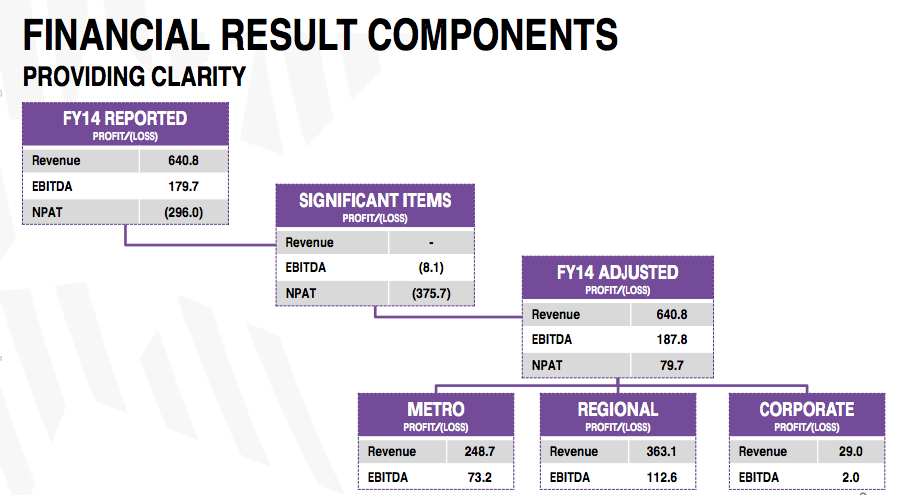

SCA CEO Rhys Holleran advised that the reported net loss after tax of $296.0m has been impacted by a number of significant items that primarily relate to the impairment of the Group’s Regional assets, the resolution of the tax dispute and the refinancing of the debt facility in January 2014.

The net loss of $296m represents the after tax figure, including significant items, a change of 408%.

The dividend for the shares to be paid on November 14 is 3 cents, down from 4.5 cents in April.

Key results highlights include:

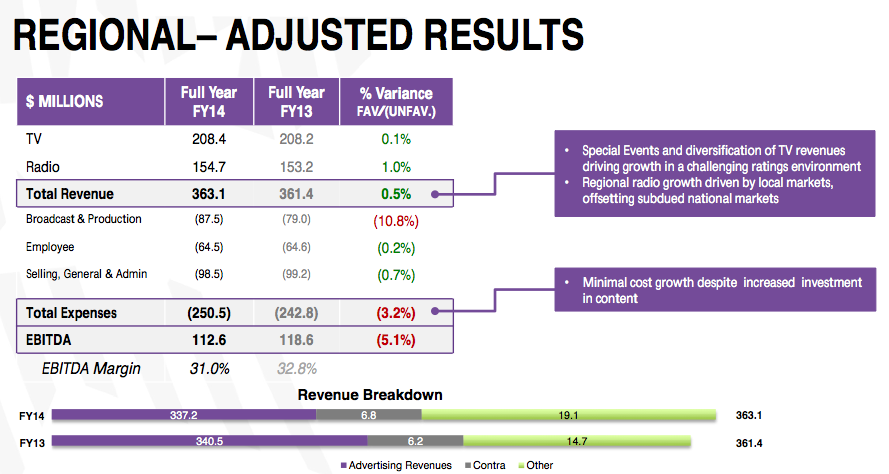

- Revenue from continuing operations up 0.5%

- Refinance of syndicated debt facility delivered a $4.0m saving in net finance costs in H2 FY14

- Net debt for the borrowing group reduced further to $594.4m

- Strong underlying cashflows

- 103.8% of EBITDA (excluding significant items) converted to cash

- Radio brands remain dominant in key demographics

- Significant growth in online and social media ratings

- Leverage ratio at 2.93 and interest cover ratio at 4.61, well within covenant levels

View SCA’s presentation to investors here.

‘Impairment of intangibles and investments’ is noted as causing a $392.5 million loss. Underlying results, without the impairment charges, show that the company’s divisions are profitable.

Company wide revenue has fallen 0.3% to $640.8m, but costs have been tightly controlled, decreasing by 2.6% to $453 million.

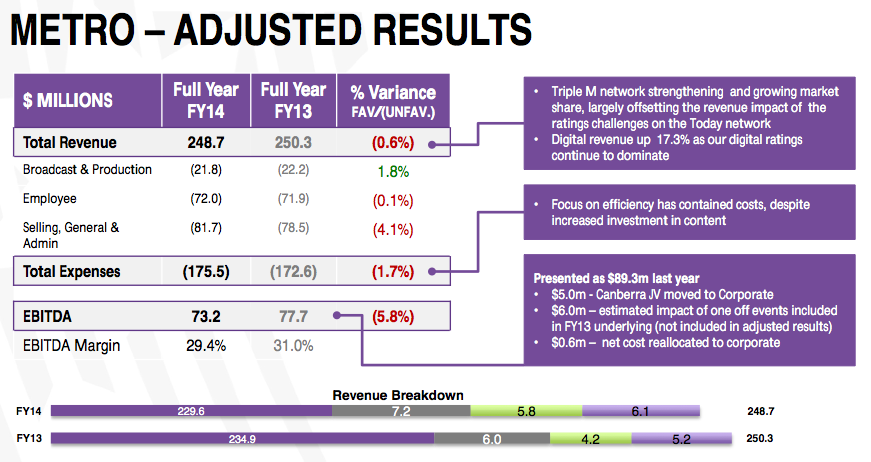

The “regeneration of the Today network is well underway with 60% of the revenue decline being offset by the growth of the Triple M network” according to the results presentation. Costs of the Canberra 50% joint venture with ARN were allocated to the Corporate division in the previous funancial year and were not counted in the metro or regional results this year.