In its half yearly report to stockholders today, HT&E has reported a decline in revenue of $39.8m on last year, while costs are down by $18.4m (19.2%).

The underlying EBITDA from continuing operations is down by 49%, from $38.1m last year to $19.5m.

The results for ARN have impacted HT&E’s overall performance with revenue for their radio arm down 27% to $83.1M from $115m, while total costs are down 14%.

Staff costs have only been minimally reduced to $39.7m, or 2%.

Overall HT&E still has a very good cash balance of $90.1m.

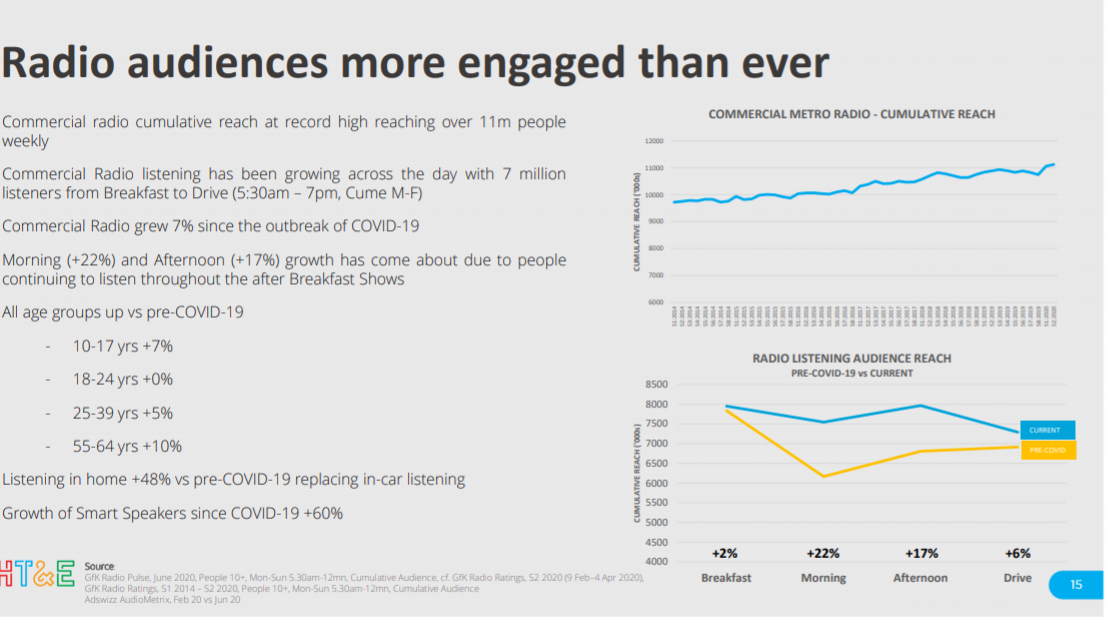

On the plus side there has been an increase in radio listenership during COVID-19 and record iHeartRadio growth.

HT&E CEO and Managing Director, Ciaran Davis, said, “ARN is the #1 commercial metro radio network, is the #1 podcast publisher, has one of the largest libraries of digital audio content in the world, and we have a clear strategy to transition from a linear radio business to an audience centric, digital audio and content business.

“Radio will continue to play a very important role in consumer consumption of audio, and maximising returns from our core business operations remains the priority. We are looking to build more engaged audiences through data and personalisation, using enhanced digital audio formats and delivering new products for advertisers with greater targeting capabilities.

“ARN is in a very strong position to utilise the power of its brands and personalities, as well as its exclusive iHeartRadio licence, to help make this transition. Our iHeartRadio registered users now stands at 1.7 million; listening to live radio on the platform grew 9%, podcasting increased 33% and music streaming was up 31%.

“Our focus for the next six months is building on our sector leadership position in audio entertainment and while remaining vigilant around costs, investing in the skills and capability we need to deliver on our strategy.

“COVID-19 has provided key insights around audio, and our audiences are now more engaged with audio than ever before. We are committed to growing market share and are incredibly well positioned to benefit as advertising markets recover.”

Subscribe to the radioinfo flash briefing podcast on these platforms: Acast, Apple iTunes Podcasts, Podtail, Spotify, Google Podcasts, TuneIn, or wherever you get your podcasts.