McKinsey and Company has been tracking consumer sentiment around the world since the beginning of the COVID19 pandemic, exploring the economic effects of the virus, as well as consumption patterns and media usage.

As you would expect, the research has found that consumers in most countries are delaying purchases, except for basics, and many feel insecure in their jobs. While expenditure in other areas is decreasing, most consumers in the countries studied report that they are or will spend more money on home entertainment.

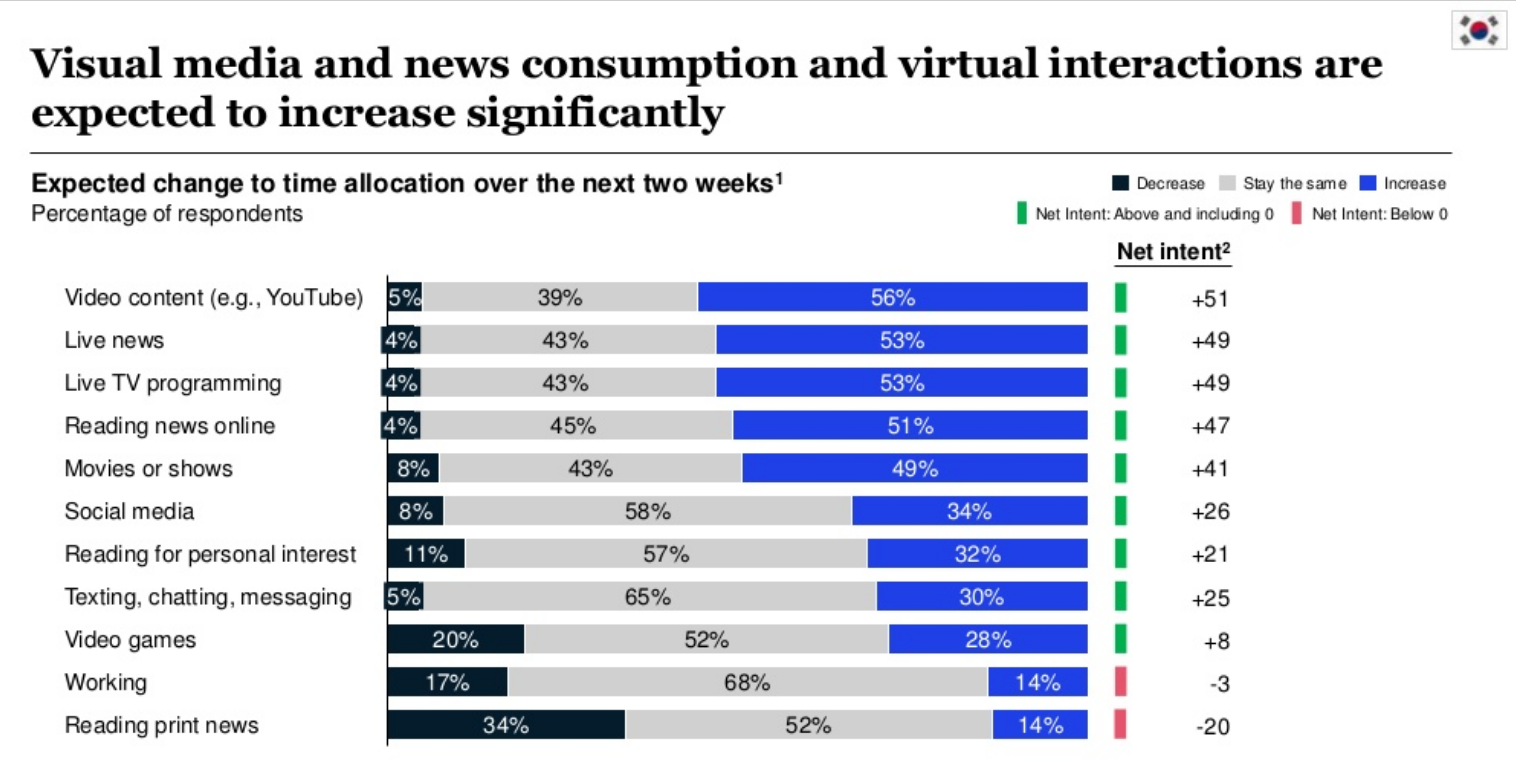

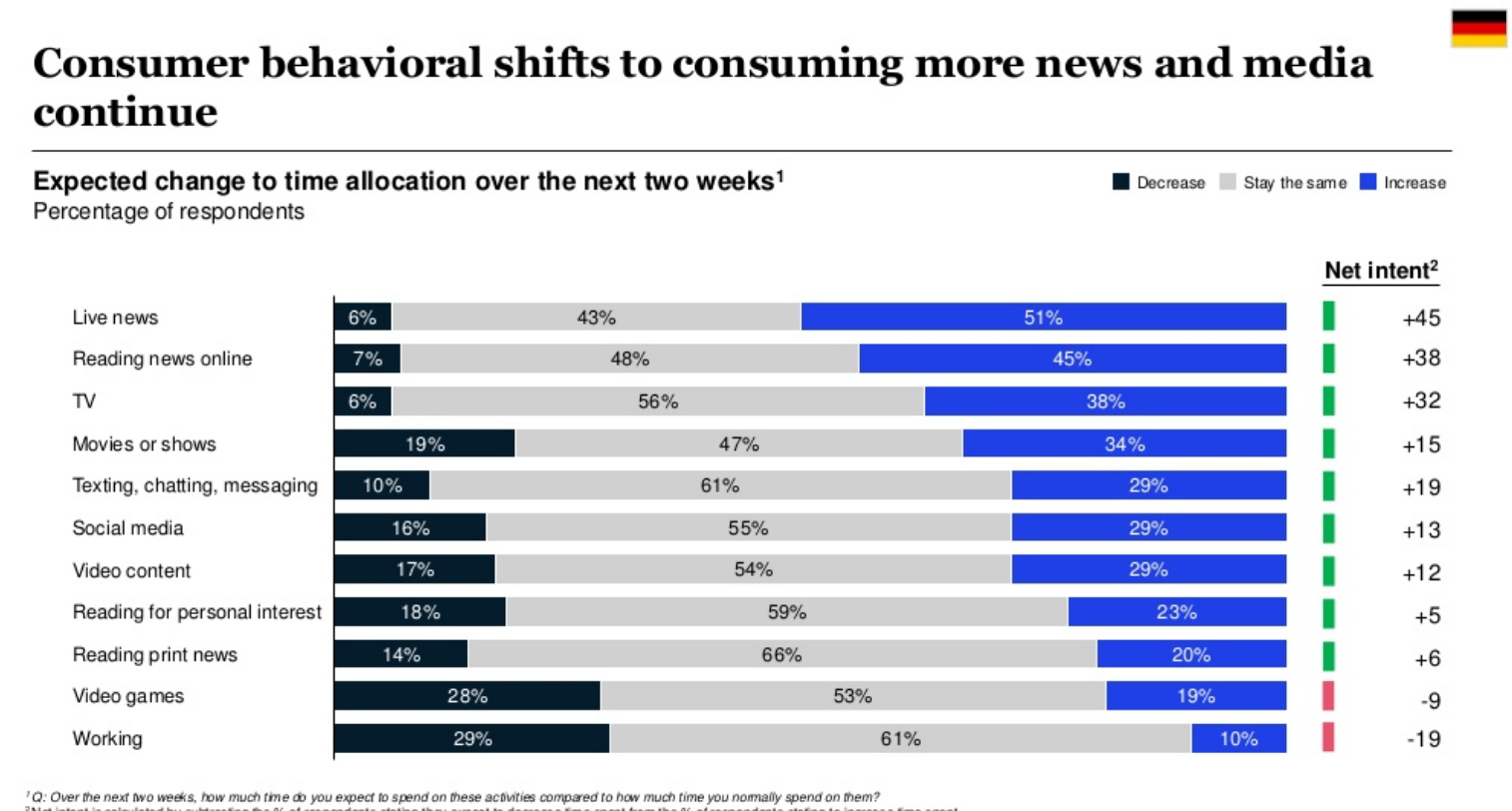

The study asked consumer panel members whether the intend to change the amount of time they spend with media over the next two weeks. The study did not specifically break out radio/audio in its questioning, but it does provide an overall indication of general media consumption. Key results by country include:

Britain

As the pandemic worsens in the UK and some incomes begin to take a hit, consumer optimism is declining. They are settling in for what they think will be a long haul, decreasing discretionary expenditure but increasing expenditure on groceries, cleaning products, books and home entertainment as they settle into isolation, like their prime minister.

Chatting, live news and movies are the top media consumption increases expected in the coming fortnight, while Britons expect to do less work and read fewer newspapers in coming weeks.

America

Optimism is falling in the US as the death toll mounts and hospitals become overcrowded.

Consumers are starting to adopt new behaviours as well, such as shopping new websites for basics (15 percent), changing primary grocery stores (13 percent), adopting curbside restaurant and store pickup (10 percent and 8 percent), and trying video conferences for professional /personal reasons for the first time (9 percent and 8 percent). There are several additional categories where consumers are increasing their participation, such as entertainment streaming, e-sports, and online fitness.

In the next fortnight Americans intend to do more cooking (up 60%), and watch more movies and live news.

Japan

Concerns about the economy and how long the crisis will last are top of mind for most Japanese consumers. The impact on jobs and willingness to spend is being felt by more consumers, resulting in an expected reduction of spending across almost all categories, except groceries and at-home entertainment.

Consumers are craving news, via live broadcasts or online and intend to spend less time working in coming weeks.

Korea

South Korea’s COVID-19 situation has stabilized in recent weeks, with new cases dropping to between 50 and 150 daily. However, success in managing the virus has not translated to consumer sentiments. Only 25 percent of consumers surveyed are confident of a quick rebound.

Koreans report a sharp increase in time spent consuming news, watching TV and other visual media. Print news consumption is declining.

China

With China reporting a decrease in COVID cases, there is more optimism in society. In a country where media is tightly controlled, the consumption and work patterns are very different from other countries studied, as are media consumption patterns.

In contrast to every other country studied, Chinese citizens intend to get back to work in the next fortnight (up 35%) after severe lockdowns in many parts of that country in the past month. Consumption of news and social media will also increase, and they expect to play less video games as they emerge from their lockdowns.

Indonesia

In a country where the health system is unlikely to cope with the onslaught of the virus, two thirds of consumers surveyed say they are very concerned about overall public health and the safety of their family.

Consumers expect to shift their purchases more to online buying and to increase their total consumption of media across all categories.

France

French citizens intend to increase their viewing of live news by 46% in the next two weeks. Watching TV, chatting or messaging friends, reading online news, using social media and watching movies will also increase. Discretionary non-food online shopping will decrease, so will the amount of hours spent working (it is Easter).

Germany

Live news consumption will increase most in Germany (up 51%), followed by reading news online, watching tv and movies then chatting.

In Germany, the prevailing sentiment is uncertainty, but compared to other European countries, German consumers have greater optimism for a quick economic recovery, but they are cutting back their spending.

Italy

In Italy, where the virus has hit so hard, economic conditions continue to decline and there is low consumer confidence. 83% of those surveyed said they have been personally affected by the virus in some way. Italians intend to cut back on everything except home entertainment in the next fortnight.

Consuming news will increase, as will live tv, chatting and watching videos and tv, as they seek to keep in touch with family and keep up with the developing deadly situation.

The company will continue to track changing consumer sentiments in various countries while the pandemic remains active. Check the latest stats here.

Subscribe to the radioinfo daily flash briefing podcast on these platforms: Acast, Apple iTunes Podcasts, Podtail, Spotify, Google Podcasts, TuneIn, or wherever you get your podcasts.